February 22, 2019

VIA EDGAR

Mr. Brad Skinner

Senior Assistance Chief Accountant

United States Securities and Exchange Commission

Division of Corporation Finance – Office of Natural Resources

Washington, DC 20549

| RE: | Ring Energy, Inc. |

Form 10-K for Fiscal Year Ended

December 31, 2017

File No. 001-36057

Dear Mr. Skinner:

Ring Energy, Inc., a Nevada corporation (the “Company,” “we,” “us,” or “our”) is submitting this letter in response to the comment letter from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) dated February 21, 2019 (the “Comment Letter”) with respect to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (File No. 001-36057) (the “Form 10-K”) filed with the Commission on March 15, 2018.

This letter sets forth the comments of the Staff in the Comment Letter (numbered in accordance with the Comment Letter) and, following each comment, sets forth our response.

Form 10-K for the Fiscal Year Ended December 31, 2017

Supplemental Information on Oil and Gas Producing Activities (Unaudited) Reserves Quantities Information, page F-22

| 1. | We have read your response to comment 9 and note the illustration of your proposed future disclosure does not include separate disclosure of the figures for the proved developed and proved undeveloped reserves at the beginning of the first period shown, e.g. December 31, 2015. Revise your proposed future disclosure to meet the requirements pursuant to FASB ASC 932-235-50-4 and the illustration in Example 1 of FASB ASC 932-235-50-2. |

Ring Energy, Inc. File No. 001-36057 Page 2 |

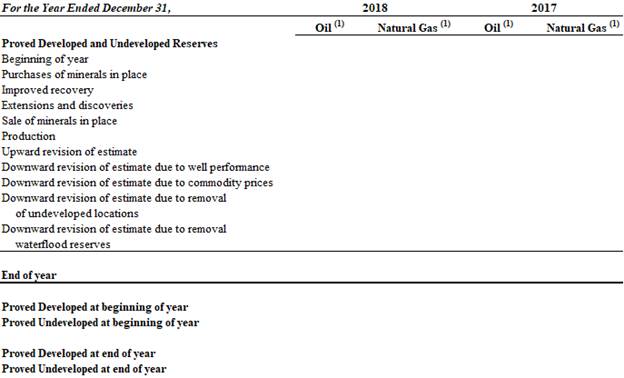

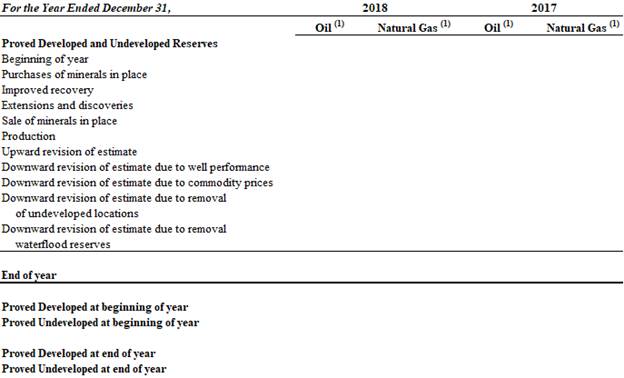

Response 1: We will expand the table in our upcoming 2018 Annual Report on Form 10-K to include a separate disclosure of the figures for the proved developed and proved undeveloped reserves at the beginning of the first period shown as follows:

1 Oil reserves are stated in barrels; gas reserves are stated in thousand cubic feet.

| 2. | We have read your response to comment 10 and note the illustration of your proposed future disclosure relates to the changes in the standardized measure of discounted future net cash flows pursuant to FASB ASC 932-235-35. Clarify for us that in the future you also intend to similarly revise your disclosure to include greater detail in the reconciliation of the changes in total proved reserves pursuant to the requirements in FASB ASC 932- 235-50-5 and in your presentation of the changes in proved undeveloped reserves as currently provided on page 17 pursuant to the requirements in Item 1203(b) of Regulation S-K. |

Response 2: With respect to our upcoming 2018 Annual Report on Form 10-K, we will be sure to include greater detail in the reconciliation of the changes in total proved reserves and unproved reserves. We believe the table included in response to comment 1 above partially addresses this request. In addition, we will also include the following narrative:

Ring Energy, Inc. File No. 001-36057 Page 3 |

| · | During the year ended December 31, 2018, we incurred costs of approximately [$____] million to convert [_____] BOE of reserves from PUD to PDP through development. |

| · | Other changes to our PUD reserves included: |

| o | Purchase of minerals in place of [_____] BOE. |

| o | Extensions and discoveries of [_____] BOE. |

| o | Upward revisions of [_____] BOE as a result of reduction in lease operating expenses in certain areas. |

| o | Downward revisions of [_____] BOE from the removal of PUD wells as a result of development of additional horizontal reserves in their place. |

| o | Downward revisions of [_____] BOE for the removal of waterflood reserves and the removal of primary reserves related to development for the waterflood as it was determined that horizontal development of this acreage was more economical than the remaining primary development and waterflood installation. |

In addition to the above responses, we acknowledge that: (i) the Company is responsible for the adequacy and accuracy of the disclosure in the filing; (ii) Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and (iii) the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

If you have any questions or comments concerning these responses, please do not hesitate to call me at (918) 499-3880, or our counsel, Mark L. Jones of Baker & Hostetler LLP at (713) 646-1395.

Sincerely,

/s/ William R. Broaddrick

William R. Broaddrick

Chief Financial Officer